THINK

Digital signage in bank branches has become essential in transforming customer experiences and communication methods. However, there remains a debate in many institutions on the value of investing in digital platforms within the branch. This report confirms the significant impact of digital signage from consumer and banker perspectives, identifying opportunities to improve digital signage strategies, enhance customer engagement, and support operational efficiency.

The study’s primary objective was to gather consumer and bankers’ feedback regarding their experiences with digital signage in banks. Combining these insights offers a comprehensive view of the digital signage landscape within banks, revealing the complex dynamics at play. This dual perspective helps understand how these digital tools impact customers and bankers, uncovering areas of agreement and where there is misalignment. The study aimed to fully understand how digital solutions shape customer experiences, perceptions, and satisfaction.

BLINK

Customer Preferences and Experiences

Satisfaction and Priorities: Overall, customers are relatively satisfied with their banking experience, with 54% reporting they are very satisfied. Customers prioritize convenience factors, such as ease of doing banking, great online and mobile platforms, and customer service. The study found that customers who visit the branch multiple times a week are more satisfied (65%) than those who visit once a year or less (50%).

Transactional View: Customers generally view their relationship with banks as functional. Only 26% see their relationship with their bank as a trusted relationship with long-term benefits. These customers are the most satisfied, with 71% reporting high satisfaction compared to 45% high satisfaction amongst those who see banks as a place to access money.

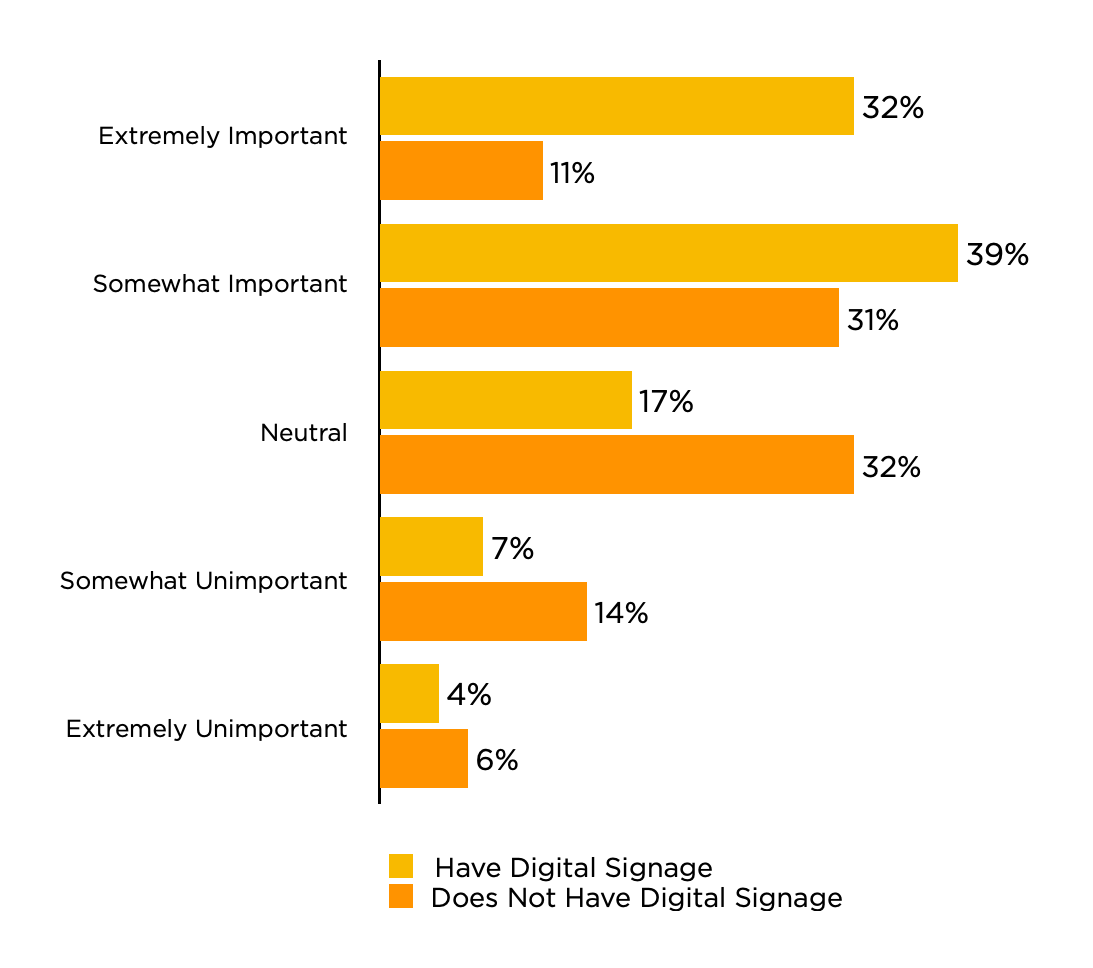

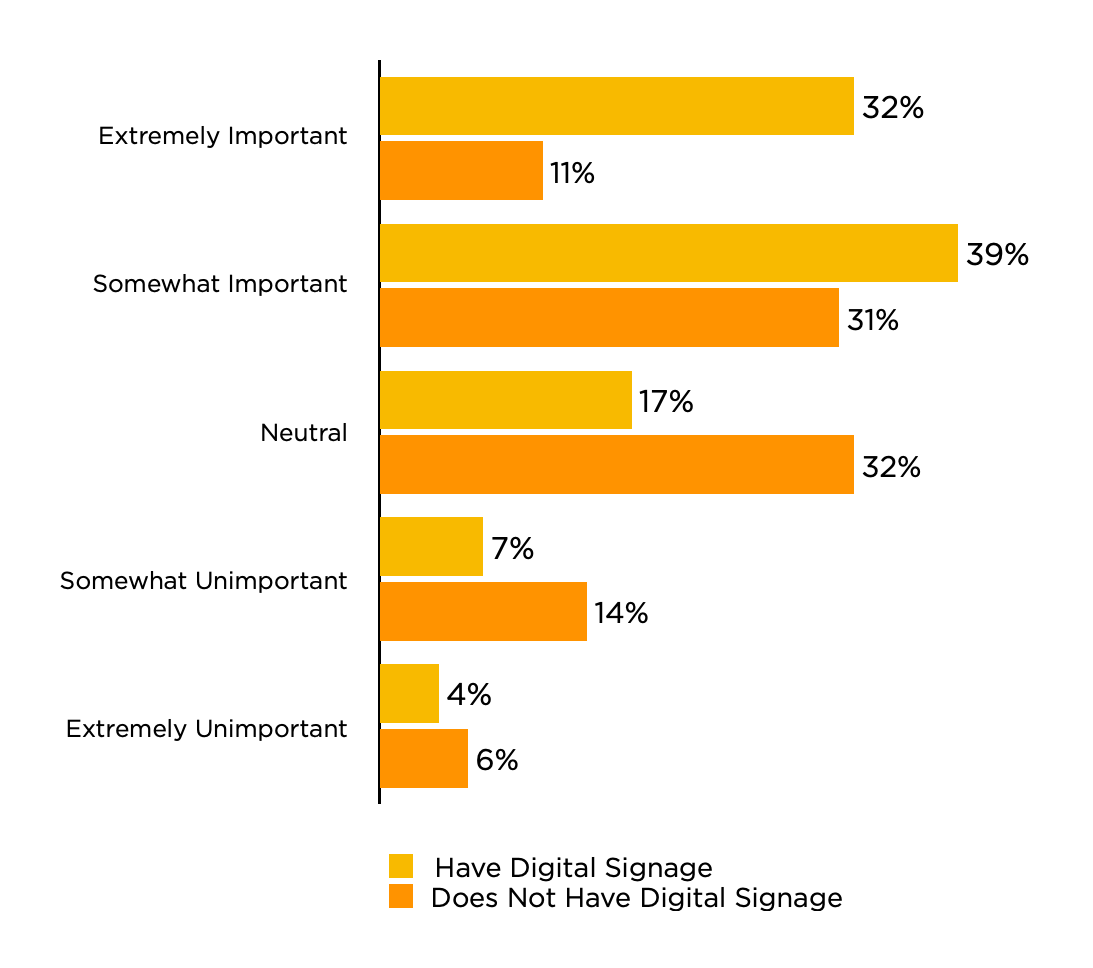

Consumer Perception: The study found that digital signage positively impacts consumer perceptions, and overall satisfaction. Most consumers find digital signage important in assisting them with their banking needs. Those who state their primary bank features digital signage are more likely to find it helpful, suggesting that exposure to digital signage could lead to a more positive attitude. In addition, those who report their bank has digital signage are also more likely to report their relationship with the bank is a trusted relationship with long-term benefits compared to those who do not report signage in their primary bank. (31% vs. 20%).

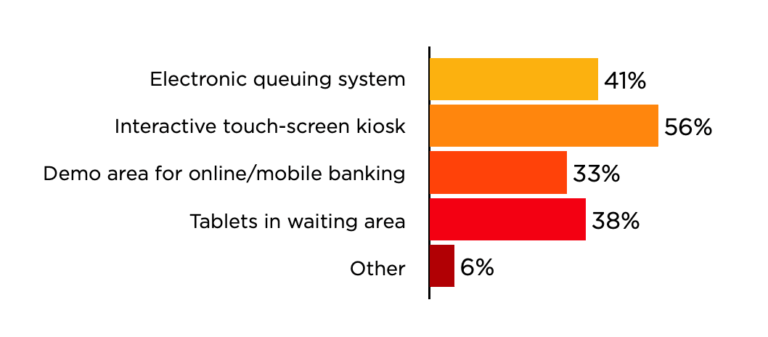

Engagement and Features: Consumers value innovative technology when interacting with digital signage in bank branches. They prefer interactive features, such as touch-screen kiosks and tablets in waiting areas, indicating a desire for engaging experiences rather than passive content consumption.

Content Preferences: Consumers strongly preferred content related to rates and fees, likely due to the current economic climate. Other preferred content includes information on checking and savings accounts, investments, and community and social causes. Frequent branch visitors expressed a higher interest in a broader range of content, including local and regional messaging.

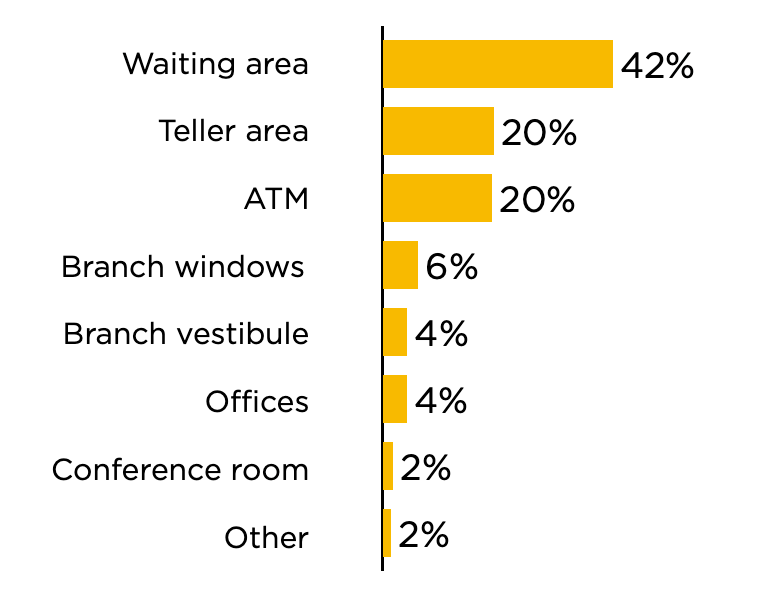

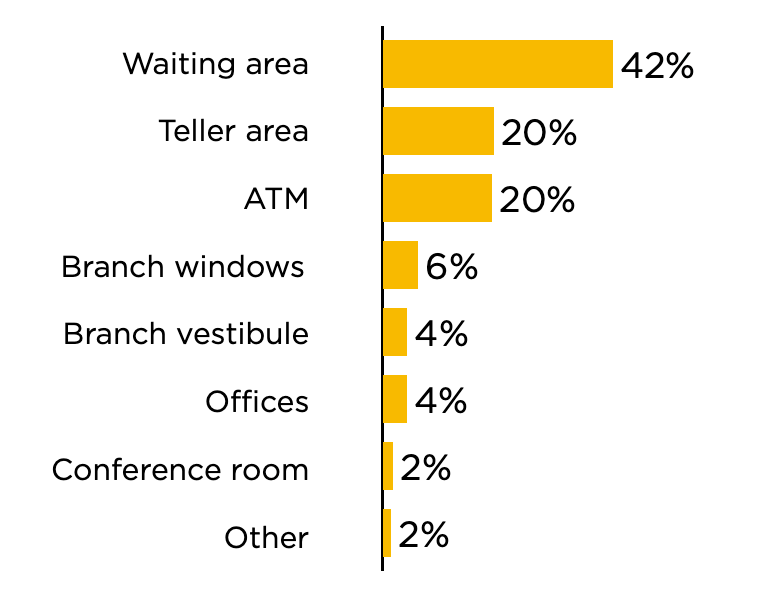

Location and Recall: The study revealed that customers notice digital signage primarily within the branch, especially in waiting areas. However, there is a discrepancy between bankers’ and consumers’ perceptions of signage location effectiveness. For example, bank branch windows are commonly used for digital signage, but only 30% of consumers notice them. This indicates a need for more strategic placement or different content for exterior-facing signs.

IMPORTANCE OF DIGITAL SIGNAGE

How important is in-branch digital signage in providing information to assist you in your banking?

BANKER INSIGHTS

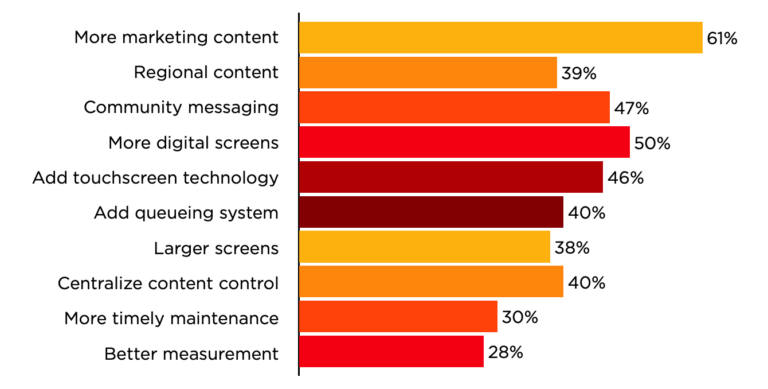

Content Management: The study highlighted that many banks need a centralized or unified approach to managing digital signage content. Multiple teams often manage content, leading to potential inconsistencies. Bankers emphasize the need for more localized and interactive content and a more centralized approach to ensure quality and consistency.

Measurement Tools: Banks use various tools to measure the effectiveness of digital signage, with a preference for online surveys (26%) and sales increase metrics (18%). However, more accurate methods like A/B tests and randomized control trials are rarely used (1% each). The study suggests that improving measurement tools and processes is crucial for better strategy optimization and higher accuracy in assessing digital signage effectiveness.

Placement Optimization: Position digital signage in high-traffic areas within bank branches to maximize visibility and impact. Consider consumer behavior patterns and attention hotspots to ensure effective communication and engagement, especially in teller and ATM zones. This strategic placement increases the effectiveness of digital signage by reaching a wider audience and capturing customer attention at key in-store touchpoints.

MOST TIME VIEWING DIGITAL SIGNS

Where do you recall spending the MOST time looking at digital signs in your bank?

Customized Content: Improve digital signage by providing more relevant content, including regional and community-specific messaging. Centralizing control across all digital content platforms, including ATMs and customer-facing employee screens, ensures consistency and unified messaging.

Interactive Integration: Incorporate interactive elements into digital signage to encourage customer engagement and drive desired actions. Features such as QR codes, touchscreens, and electronic queueing systems enhance the user experience, making it more immersive and engaging.

PREFERRED FEATURES

Which would provide a better banking experience?

Advanced Measurement: Invest in advanced analytics, real-time tracking, and comprehensive reporting mechanisms to gain deeper insights into customer engagement, content performance, and overall impact. Accurate data and various evaluation methods can provide a more vital causal link and enable data-driven decision-making for strategy optimization.

More Marketing Content: A critical opportunity lies in increasing the volume and relevance of marketing content displayed on digital signage platforms. By enriching messaging with compelling visuals, targeted promotions, and tailored communications, banks can create more immersive and personalized customer experiences.

IMPROVING IN-BRANCH DIGITAL SIGNAGE

What would you change to improve your current in-branch digital program?

CONCLUSION

The research findings identified digital signage significantly enhances the customer experience by providing interactive features, personalized content, and convenient access to information. Both consumers and bankers view digital signage positively, with opportunities for improvement through better measurement, personalization, and strategic content placement. Financial institutions must prioritize customer engagement by delivering relevant and interactive content to increase satisfaction and loyalty. Regular updates and optimizations will help banks stay ahead in leveraging digital signage technology. Download our full report below for a comprehensive review of our study results.

About the author

Jean-Pierre Lacroix

President of Shikatani Lacroix Design