For banks, Customer Experience (CX) transformation is full of challenges and opportunities. As markets evolve, new regulations are introduced, and financial behaviors shift, businesses must adapt and reinvent themselves to stay relevant.

Drawing insights from our studies, particularly from our white papers “Overcoming Stealth Attrition In Retail Banking” in 2017 and “How Branch-Focused Customer Experiences Can Increase Advice-Driven Services” in 2023, this blog offers a deeper dive into six critical mistakes banks should avoid during CX transformation.

CX Transformation

In an era marked by rapid technological advancements and changing customer expectations, CX transformation is not just an option; it’s a necessity. This process involves rethinking the brand values, messages, and audience engagement.

Image Source: Shutterstock

Critical Mistakes in CX Transformation

1. Ignoring Customer Needs and Feedback

One of the most shocking findings from our studies was the disconnect between what customers seek in financial advice and what is provided by banks. This gap underscores that most banks overlook customer feedback and needs. Our 2022 study “Measuring What Matters” identified that financial institutions measure what matters to themselves: revenue, growth, efficiency, and customer loyalty. Yet, customers value recognition, advice, convenience, and empathy. Many of these customer needs aren’t tracked by institutions. Understanding and integrating customer insights into every decision is important for successful brand transformation. Companies must employ robust feedback mechanisms like surveys, focus group interviews, and social media interactions to gather customer insights.

These kinds of engagement should not be a one-off research activity but a continuous dialogue that guides the transformation process, ensuring that the brand evolves in a direction that resonates with its audience. To assist you in the process, we’ve created an easy-to-follow worksheet on CX assessment:

2. Not Having a Clearly Defined Value Proposition

Markets evolve quickly, with new entries disrupting established players by offering unique value propositions that answer unmet customer needs. The fintech industry is rapidly filling the service gap that current financial institutions aren’t willing to invest in due to complexity or limited revenue potential. The role of any transformational initiative is to ensure the brand remains relevant and future-proof. Identifying and fine-tuning a value proposition that resonates with current and potential customers is fundamental to successful change management.

In addition, knowing the gaps between customer needs and current offerings can help guide the transformation. Putting greater importance on the emotional drivers of brands will ensure the updated value proposition addresses customer needs. Research firms like Hotspex have pioneered identifying the emotional drivers for financial institutions to help banks differentiate from competitors.

3. Overlooking Employee Engagement and Training

Our studies identified another vital aspect for successful CX transformation — employee engagement. Financial institutions struggled to fully leverage their staff in offering advice-driven services, primarily due to inadequate training and engagement. In addition, the legacy approach of speeding up in-branch transactions often goes against quality advice.

However, employees are the lifeblood of any brand. Their buy-in is crucial for a transformation program to take root. Brands must invest in comprehensive training programs that impart the skills needed for new brand directions, and align employees with the new value proposition. Organizations like ath Power Consulting have mastered employee training which shifts their mindset from transaction to advice. Engaging employees in the transformation process, encouraging feedback, and recognizing their contributions can foster a sense of ownership and commitment. Besides, establishing benchmarks to track engagement and employee reward programs can ensure the training leads to predictable and repeatable behaviors.

4. Failing to Adapt to Digital Trends

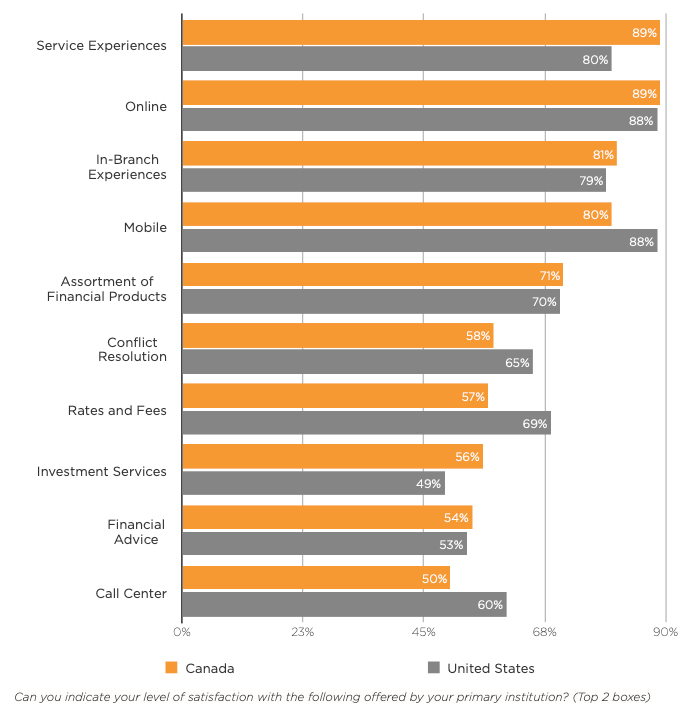

Digital platforms are critical in enhancing customer satisfaction in terms of convenience. A CX transformation program that pays little attention to the digital dimension and how it is integrated seamlessly with the physical branch networks is bound to miss its mark. Embracing digital trends is essential, from social media engagement and online customer service to leveraging data analytics for personalized marketing.

However, it’s not just about having a digital presence; it’s about creating meaningful, engaging digital experiences that align with the brand identity and meet customer expectations. This requires a strategic approach to digital, integrating it seamlessly with the brand’s overall transformation strategy and CX journey. Many of these initiatives, unfortunately, end at the branch’s doorstep. They have to be integrated with the in-branch CX. Understanding the current gaps in conflict resolution and financial advice can help streamline customer experiences.

Image Source: SLD

5. Underestimating the Importance of Physical Touchpoints

Despite the digital shift, it’s essential to enhance physical touchpoints in the banking industry. While digital platforms have allowed for greater convenience, it’s the physical branded experience that drives growth and loyalty. Customers enter a branch out of learned behaviors through interactions with other retail brands across industries. Physical spaces, offices, uniforms, and packaging can significantly influence customer perception. These touchpoints offer unique opportunities to embody the brand values and connect with customers personally. Therefore, reimagining a financial institution’s physical experiences to align with the new brand direction is essential to the transformation. This could mean redesigning physical spaces, enhancing face-to-face interactions, or innovating product or service packaging. If aligned, all touchpoints can communicate a consistent brand message.

6. Neglecting Consistency Across All Brand Elements

Consistency is the cornerstone of brand recognition. During CX transformation, brands must ensure coherence across all brand elements — visual identity, messaging, and beyond. It helps maintain trust and ease the transition for customers, helping them understand and embrace the brand’s new direction.

The process involves meticulous planning and execution, from updating logos and color schemes to ensuring that all internal and external communications reflect the new brand ethos. Brands must also consider how changes will be perceived across cultures and regions to maintain a consistent and relevant presence worldwide, especially for global brands. With the growth of a diverse population with unique values, consistency has become increasingly important. Brands should take into account these cultures while remaining consistent with their core brand identity.

Image Source: Shutterstock

Conclusion: Navigating the Path to Successful CX Transformation

Customer Experience transformation is a complex yet rewarding journey. It offers renewal and growth opportunities but requires careful navigation to avoid mistakes. The insights from the banking industry provide valuable lessons for brands across sectors. By prioritizing customer needs and feedback, engaging and training employees, adapting to digital trends while enhancing physical touchpoints, and maintaining consistency, brands can successfully navigate CX transformation.

A successful brand transformation is more than logo and tagline updates. It’s about fundamentally rethinking how the brand should engage with its audience. It’s a strategic, holistic process that touches every aspect of the organization and its market presence. When executed correctly, it can reinvigorate a brand, deepen customer relationships, and set the stage for a new chapter of growth and innovation.